Table of content :

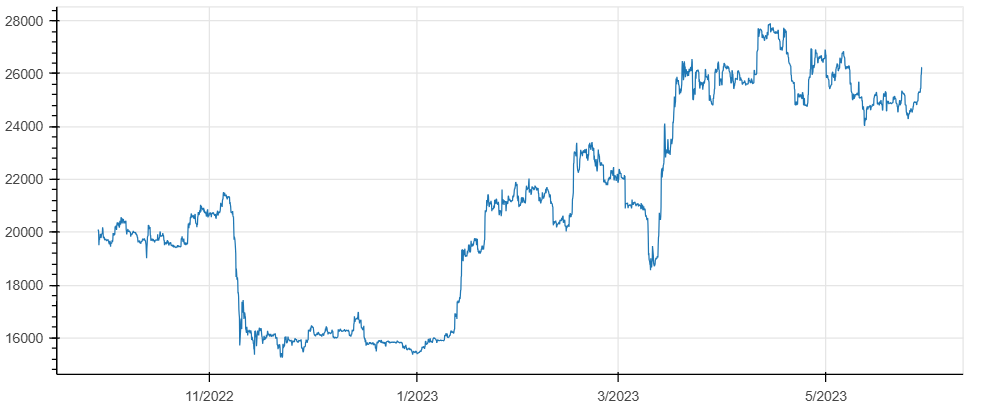

Backtesting - Deathcross

$$ POS(t_n) = \biggl[ {EMA}_{20}(t_n) > SMA_{200}(t_n) \biggl] $$Données

df = pd.read_csv('btceur-2h.csv')

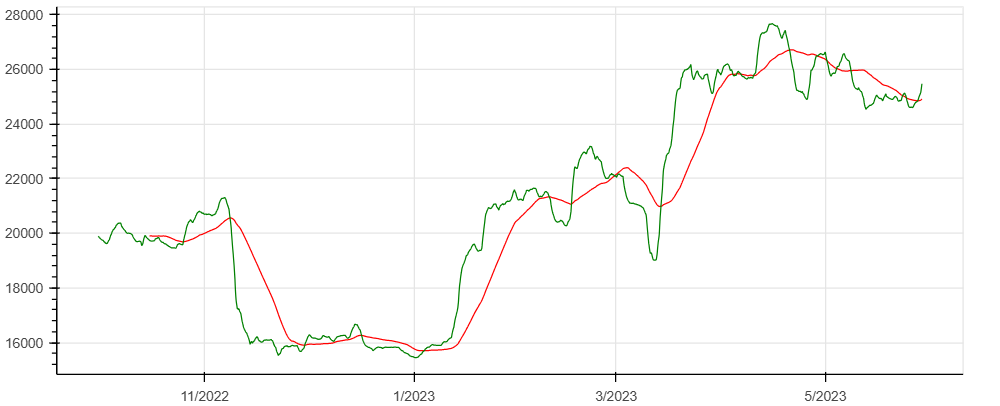

Moyennes mobiles

fast = ta.EMA(df['close'], timeperiod = 20)

slow = ta.SMA(df['close'], timeperiod = 200)

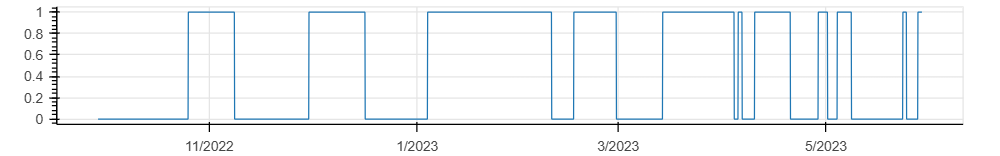

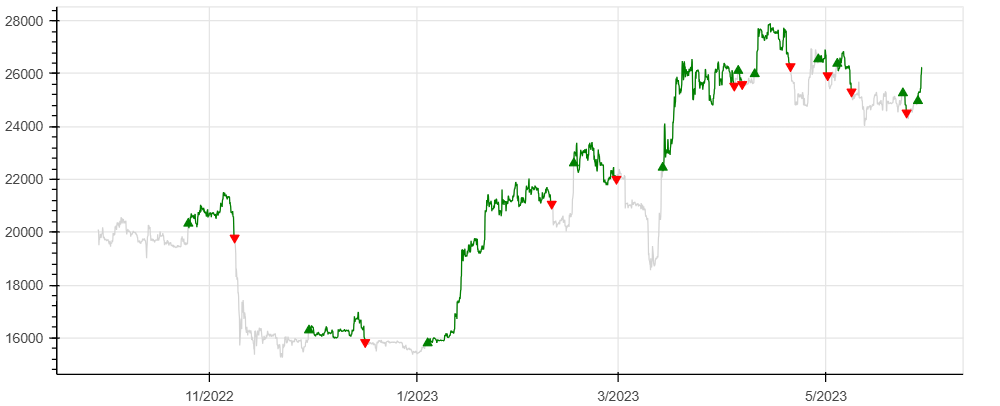

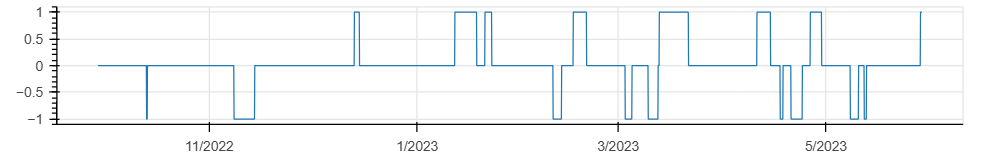

Positions

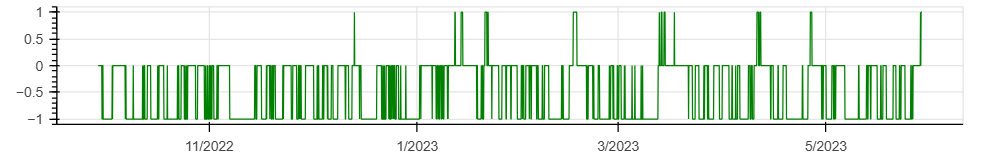

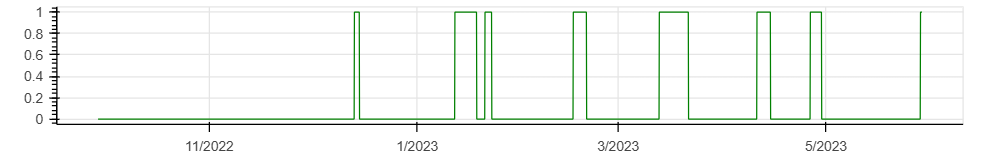

position = fast > slow

Rendement en HODL

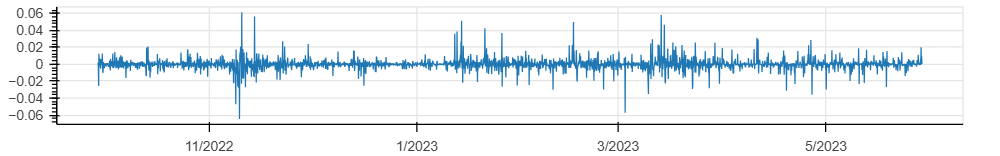

returns_hodl = np.log(df.close / df.close.shift())

Rendement stratégie

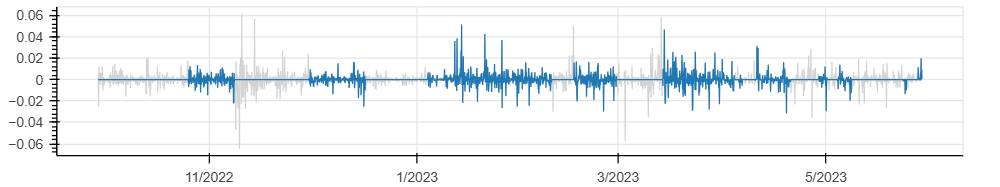

returns_strat = returns_hodl * (position.shift() == 1)

returns_fee = np.log(1 - 0.0025) * (position != position.shift())

returns_netto = returns_strat + returns_fee

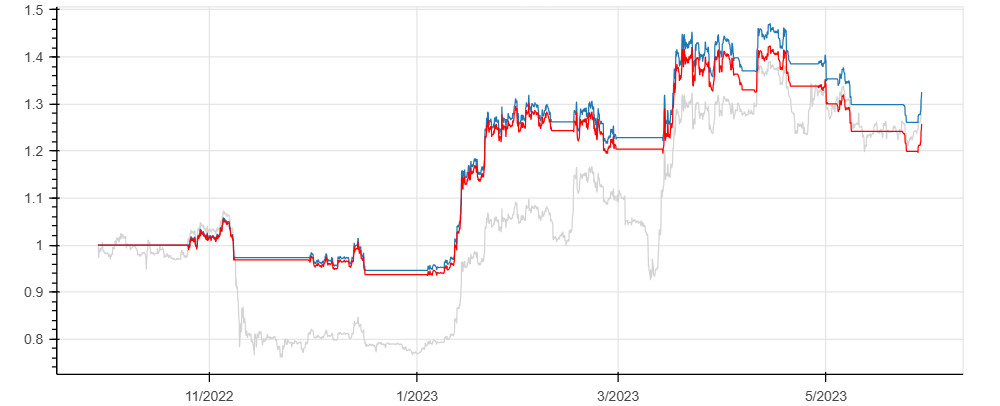

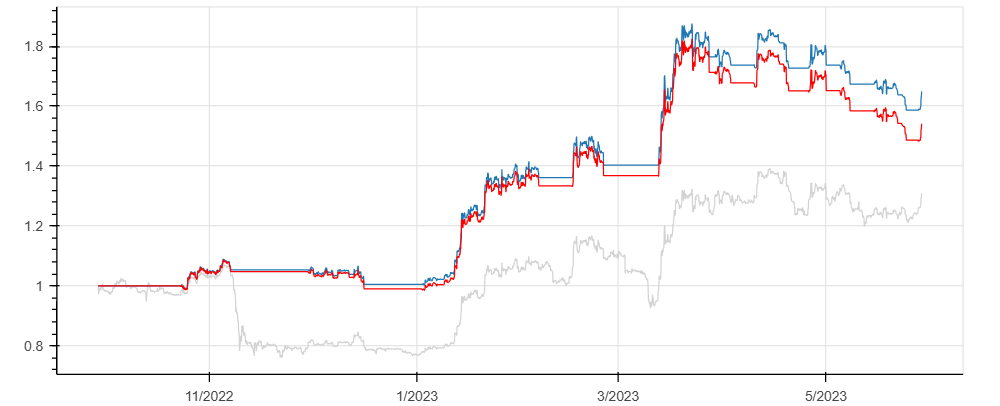

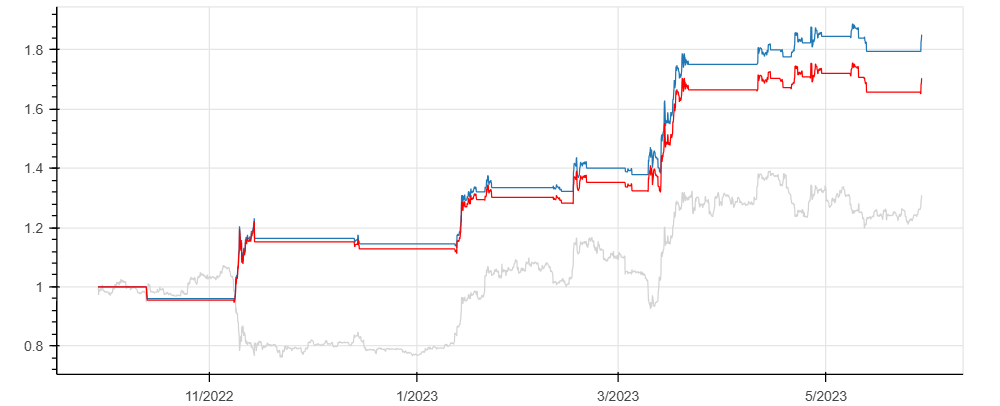

Rendement net cumulé

returns_netto_cumul = np.exp(returns_netto.cumsum())

Code

# coding: utf-8

import numpy as np

import pandas as pd

import talib as ta

df = pd.read_csv('btceur-2h.csv')

# strategy

fast = ta.EMA(df['close'], timeperiod = 20)

slow = ta.SMA(df['close'], timeperiod = 200)

position = fast > slow

# returns

returns_hodl = np.log(df.close / df.close.shift())

returns_strat = returns_hodl * (position.shift() == 1)

returns_fee = np.log(1 - 0.0025) * (position != position.shift())

returns_netto = returns_strat + returns_fee

print('Returns: ', np.exp(returns_netto.sum()))

# graphs

from bokeh.plotting import figure,show

from bokeh.layouts import column,row

df['date'] = pd.to_datetime(df.time, unit='s')

fig0 = figure(height=325, width=800, x_axis_type='datetime')

fig0.line(df.date, df.close)

fig1 = figure(height=325, width=800, x_axis_type='datetime')

#fig1.line(df.date, df.close)

fig1.line(df.date, slow, color='red')

fig1.line(df.date, fast, color='green')

fig2 = figure(height=125, width=800, x_axis_type='datetime')

fig2.line(df.date, position)

fig3 = figure(height=325, width=800, x_axis_type='datetime')

position_in = (position == 1) & (position.shift() == 0)

position_out = (position == 0) & (position.shift() == 1)

fig3.line(df.date, df.close, color='lightgray')

fig3.line(df.date, df.close.where(position == 1, np.nan), color='green')

fig3.triangle(df.date, df.close.where(position_in), color='green', size=7)

fig3.inverted_triangle(df.date, df.close.where(position_out), color='red', size=7)

fig4 = figure(height=125, width=800, x_axis_type='datetime')

fig4.line(df.date, returns_hodl)

fig5 = figure(height=150, width=800, x_axis_type='datetime')

fig5.line(df.date, returns_hodl, color='lightgray')

fig5.line(df.date, returns_strat)

fig6 = figure(height=325, width=800, x_axis_type='datetime')

fig6.line(df.date, np.exp(returns_hodl.cumsum()), color='lightgray')

fig6.line(df.date, np.exp(returns_strat.cumsum()))

fig6.line(df.date, np.exp(returns_netto.cumsum()), color='red')

show(column(fig0, fig1, fig2, fig3, fig4, fig5, fig6))Backtesting - Trend following RSI

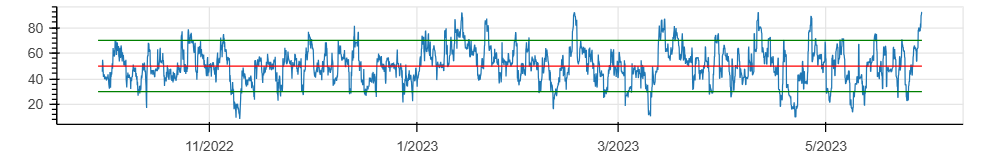

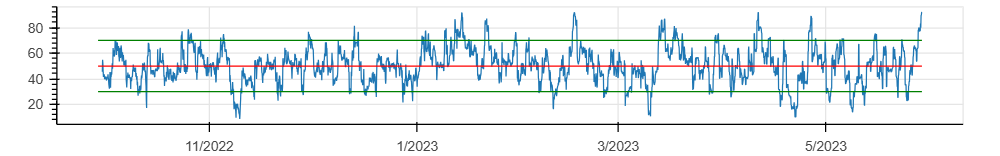

$$ SIG_{buy}(t_n) = \biggl[ RSI_{14}(t_n) > 70 \biggl] $$ $$ SIG_{sell}(t_n) = \biggl[ RSI_{14}(t_n) < 30 \biggl] $$Indicateur

RSI = ta.RSI(df.close, timeperiod = 14)

Signal

signal_buy = RSI > 70

signal_sell = RSI < 30

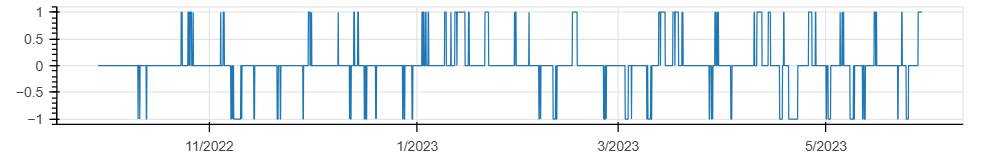

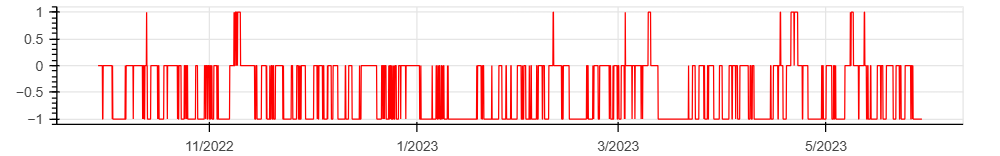

signal = signal_buy.astype(int) - signal_sell.astype(int)

Positions

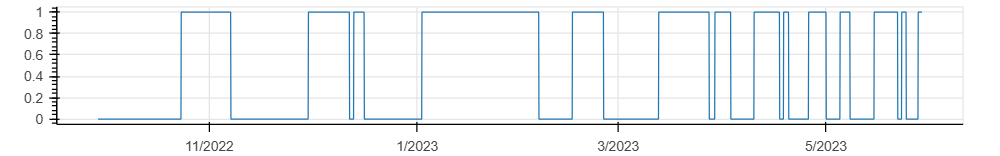

position = signal.where(signal != 0).ffill() > 0

Rendement net cumulé

Code

# coding: utf-8

import numpy as np

import pandas as pd

import talib as ta

df = pd.read_csv('./btceur-2h.csv')

# strategy

RSI = ta.RSI(df.close, timeperiod = 14)

signal_buy = RSI > 70

signal_sell = RSI < 30

# position

signal = signal_buy.astype(int) - signal_sell.astype(int)

position = signal.where(signal != 0).ffill() > 0

# returns

returns_hodl = np.log(df.close / df.close.shift())

returns_strat = returns_hodl * (position.shift() == 1)

returns_fee = np.log(1 - 0.0025) * (position != position.shift())

returns_netto = returns_strat + returns_fee

print('Returns: ', np.exp(returns_netto.sum()))

# graphs

from bokeh.plotting import figure,show

from bokeh.layouts import column,row

df['date'] = pd.to_datetime(df.time, unit='s')

fig0 = figure(height=325, width=800, x_axis_type='datetime')

fig0.line(df.date, df.close)

fig1 = figure(height=125, width=800, x_axis_type='datetime')

fig1.line(df.date, RSI)

fig1.line(df.date, 70, color='green')

fig1.line(df.date, 50, color='red')

fig1.line(df.date, 30, color='green')

fig2 = figure(height=125, width=800, x_axis_type='datetime')

fig2.line(df.date, signal)

fig3 = figure(height=125, width=800, x_axis_type='datetime')

fig3.line(df.date, position)

fig4 = figure(height=325, width=800, x_axis_type='datetime')

position_in = (position == 1) & (position.shift() == 0)

position_out = (position == 0) & (position.shift() == 1)

fig4.line(df.date, df.close, color='lightgray')

fig4.line(df.date, df.close.where(position == 1, np.nan), color='green')

fig4.triangle(df.date, df.close.where(position_in), color='green', size=7)

fig4.inverted_triangle(df.date, df.close.where(position_out), color='red', size=7)

fig5 = figure(height=125, width=800, x_axis_type='datetime')

fig5.line(df.date, returns_hodl)

fig6 = figure(height=125, width=800, x_axis_type='datetime')

fig6.line(df.date, returns_hodl, color='lightgray')

fig6.line(df.date, returns_strat)

fig6.line(df.date, returns_fee, color='red')

fig7 = figure(height=325, width=800, x_axis_type='datetime')

fig7.line(df.date, np.exp(returns_hodl.cumsum()), color='lightgray')

fig7.line(df.date, np.exp(returns_strat.cumsum()))

fig7.line(df.date, np.exp(returns_netto.cumsum()), color='red')

layout = column(fig0, fig1, fig2, fig3, fig4, fig5, fig6, fig7)

show(layout)Backtesting - Advanced trend following RSI

$$ SIG_{buy}^{long}(t_n) = \biggl[ RSI_{14}(t_n) > 80 \biggl] $$ $$ SIG_{sell}^{long}(t_n) = \biggl[ RSI_{14}(t_n) < 50 \biggl] $$ $$ SIG_{sell}^{short}(t_n) = \biggl[ RSI_{14}(t_n) < 20 \biggl] $$ $$ SIG_{buy}^{short}(t_n) = \biggl[ RSI_{14}(t_n) > 50 \biggl] $$Indicateur

RSI = ta.RSI(df.close, timeperiod = 14)

Signal long

signal_long_buy = RSI > 80

signal_long_sell = RSI < 50

signal_long = signal_long_buy.astype(int) - signal_long_sell.astype(int)

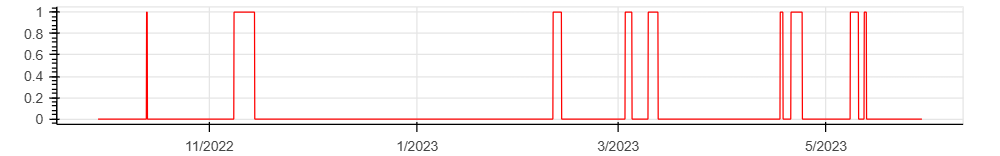

position_long = signal_long.where(signal_long != 0).ffill() > 0

Signal short

signal_short_sell = RSI < 20

signal_short_buy = RSI > 50

signal_short = signal_short_sell.astype(int) - signal_short_buy.astype(int)

position_short = signal_short.where(signal_short != 0).ffill() > 0

Position

position = position_long.astype(int) - position_short.astype(int)

Rendement net cumulé

Code

# coding: utf-8

import numpy as np

import pandas as pd

import talib as ta

df = pd.read_csv('./btceur-2h.csv')

# strategy

RSI = ta.RSI(df.close, timeperiod = 14)

signal_long_buy = RSI > 80

signal_long_sell = RSI < 50

signal_short_sell = RSI < 20

signal_short_buy = RSI > 50

# position

signal_long = signal_long_buy.astype(int) - signal_long_sell.astype(int)

signal_short = signal_short_sell.astype(int) - signal_short_buy.astype(int)

position_long = signal_long.where(signal_long != 0).ffill() > 0

position_short = signal_short.where(signal_short != 0).ffill() > 0

position = position_long.astype(int) - position_short.astype(int)

# returns

returns_hodl = np.log(df.close / df.close.shift())

returns_strat = returns_hodl * position.shift()

returns_fee = np.log(1 - 0.0025) * (position != position.shift())

returns_netto = returns_strat + returns_fee

print('Returns: ', np.exp(returns_netto.sum()))

# graphic

from bokeh.plotting import figure,show

from bokeh.layouts import column,row

df['date'] = pd.to_datetime(df.time, unit='s')

fig1 = figure(height=325, width=800, x_axis_type='datetime')

fig1.line(df.date, df.close)

fig2 = figure(height=125, width=800, x_axis_type='datetime')

fig2.line(df.date, RSI)

fig2.line(df.date, 70, color='green')

fig2.line(df.date, 50, color='red')

fig2.line(df.date, 30, color='green')

fig3 = figure(height=125, width=800, x_axis_type='datetime')

fig3.line(df.date, signal_long, color='green')

fig4 = figure(height=125, width=800, x_axis_type='datetime')

fig4.line(df.date, position_long, color='green')

fig5 = figure(height=125, width=800, x_axis_type='datetime')

fig5.line(df.date, signal_short, color='red')

fig6 = figure(height=125, width=800, x_axis_type='datetime')

fig6.line(df.date, position_short, color='red')

fig7 = figure(height=125, width=800, x_axis_type='datetime')

fig7.line(df.date, position)

fig8 = figure(height=325, width=800, x_axis_type='datetime')

position_long_in = df.close.where((position == 1) & (position.shift() != 1))

position_long_out = df.close.where((position != 1) & (position.shift() == 1))

position_short_in = df.close.where((position == -1) & (position.shift() != -1))

position_short_out = df.close.where((position != -1) & (position.shift() == -1))

fig8.line(df.date, df.close, color='gray')

fig8.triangle(df.date, position_long_in, color='cyan', size=7)

fig8.inverted_triangle(df.date, position_long_out, color='blue', size=7)

fig8.inverted_triangle(df.date, position_short_in, color='orange', size=7)

fig8.triangle(df.date, position_short_out, color='red', size=7)

fig8.line(df.date, np.where(position == 1, df.close, np.nan), color='green')

fig8.line(df.date, np.where(position == -1, df.close, np.nan), color='red')

fig9 = figure(height=150, width=800, x_axis_type='datetime')

fig9.line(df.date, returns_hodl, color='lightgray')

fig9.line(df.date, returns_strat)

fig9.line(df.date, returns_fee, color='red')

figa = figure(height=325, width=800, x_axis_type='datetime')

figa.line(df.date, np.exp(returns_hodl.cumsum()), color='lightgray')

figa.line(df.date, np.exp(returns_strat.cumsum()))

figa.line(df.date, np.exp(returns_netto.cumsum()), color='red')

layout = column(fig1, fig2, fig3, fig4, fig5, fig6, fig7, fig8, fig9, figa)

show(layout)